Content

Every piece of information on this web site is offered to have instructional intentions just and should not meet the requirements investment guidance nor an advice so you can get or offer individual ties. Before attending the website, please browse the Disclaimer and you may Formula page. There’s a growing number of advisers which make index profiles to own their customers, but many has higher lowest membership versions (tend to five hundred,100 for every home, or maybe more). For these with more more compact profiles, a far greater option is to construct and keep their profile from the an on-line broker. Indexing tips are utilized by the sophisticated retirement and you can endowment finance professionals international, and lots of of its advocates try Nobel laureates. The biggest ETF team within the Canada are Vanguard, BlackRock (iShares) and you can BMO, each of who render sophisticated reduced-cost points to own list buyers.

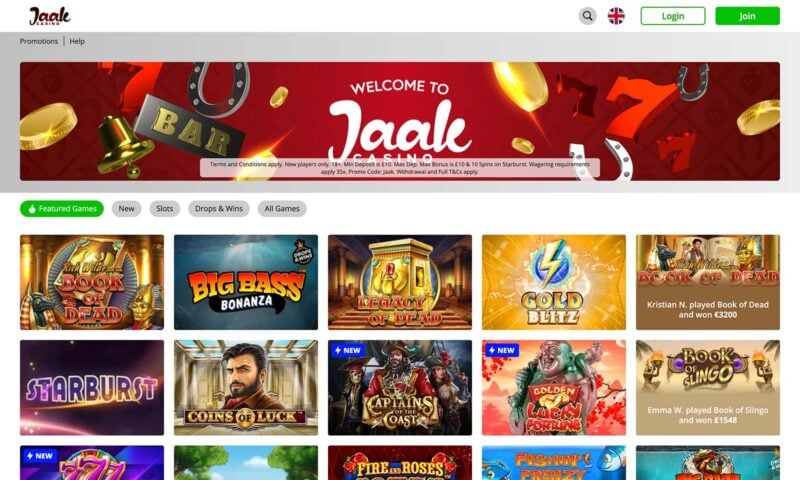

This type of ETFs offer buyers an all-in-you to portfolio https://happy-gambler.com/15-free-no-deposit-casino-bonus/ solution that’s around the world varied and instantly rebalanced, with a one-admission ultra-low-prices pick. Some great benefits of inactive using are lowest fees and you will deal will set you back, a passive method of investing, diversity due to list finance otherwise ETFs, as well as the possibility of enough time-label growth. Inactive using provides investors which have a varied collection away from index fund or ETFs. It diversification helps you to spread exposure across other investment classes, decreasing the full chance of the newest profile. The idea at the rear of this approach is always to eliminate charge and you may transaction will cost you while you are promoting variation and you can possible productivity.

We have found a comparison involving the Cutting-edge Profile models of January 2015 because of September 2022. The brand new BMO Healthy Portfolio will have outperformed the brand new State-of-the-art Well-balanced Portfolio for it several months. Once more, the brand new rising cost of living competitors might be a pull on the collection efficiency throughout the disinflationary minutes (everything we educated away from 2015 to help you 2020). That’s where is the efficiency to the collection assets on the same period.

Finest International ETFs To purchase (6 Away from Cutting edge) inside the 2025

The newest iShares Core Healthy ETF Collection (XBAL) is going to do all of the heavy-lifting. Such healthy ETFs could be a much better choice for really investors whom haven’t yet , become checked from the a-deep or expanded bear industry otherwise which just value the brand new convenience of a single-solution solution. The brand new MoneySense “Biggest Couch potato Collection Guide” suggests the many implies Canadian traders can access an inactive portfolio.

Comparable ports

As of September 2022, the fresh Conventional Profile features a small direct, due to the greater allotment to your rising prices fighters – you to Purpose Real Investment ETF. Let’s fall apart the new performance of your complex portfolios of January 2021 on September 2022. This period takes into account the beginning day to your ETF assets available. As well as the initiate day coincides for the start of rising prices concerns in early 2021. All of the charts and you will dining tables on this page try courtesy of portfoliovisualizer.com.

These negative effects you will involve nervousness, paranoia, impaired dexterity, otherwise thoughts disruptions. Some people may also sense heightened advancement, introspection, otherwise changes in temper. We’ve frogs (PEPE), pets (POPCAT), and you may an entire zoo of animal memes blowing right up. It is for instance the future of foolish money, and individuals is actually eating it upwards! If you aren’t inside with this games today, the altcoin choices are gonna shrink punctual. For real, during that time, arbitrage are swallowing from constantly.

It is because the market tends to increase in worth over time, even with motion in the short term. Which have couch potato spending, buyers is also bring it much time-identity development prospective. Other advantageous asset of passive spending is the inactive method of spending.

Both traders’ time-weighted output were along with same as that of the fresh directory their portfolios was tracking. If your investments are common inside TFSAs and you may RRSPs, following offering your existing holdings obtained’t have any income tax outcomes possibly. However, attempting to sell investment within the a non-entered membership can lead to investment growth otherwise losses, so make sure you understand why before making an option.

- While you are its purpose is actually certainly a noble one, it didn’t most obtain one traction before statement inactive came collectively.

- The borrowed funds prepayments is actually an audio choice, but they’re not just a new technique for to buy fixed-income.

- But until that takes place, the global ETF Portfolios at the very least render a less costly alternative for investors which choose never to exchange ETFs in person.

- Early in for every new-year, the brand new trader only has to split the full profile well worth because of the a couple of and rebalance the fresh portfolio by placing half the newest money on the popular brings plus the other half to the securities.

We are able to keep doing so up until i have a collection away from six money, invested in equal numbers. For each and every extra money transform the brand new size in the collection, but we’re usually paying equal amounts. You’ll i help the return—or slow down the chance— with the addition of additional money? One such collection ‘s the really-identified “Coffeehouse Portfolio.” A just about all-index fund collection, they contains 40 percent Cutting edge Complete Bond Market and you may ten percent inside all of half a dozen additional directory money. Various other is actually William Bernstein’s “Coward’s Collection”, a combination of up to 10 directory financing inside quantity away from 5 percent in order to 20 percent.

Charge to the quick account is actually another grounds to consider before you could go Do-it-yourself. Bank-owned brokerages often charge a hundred per year to your RRSPs one don’t meet their minimal membership size requirements—typically 15,one hundred thousand otherwise twenty-five,000, according to the broker. Certain may charge highest exchange income in case your equilibrium is below a specific threshold. It’s rarely well worth paying these membership charges, so if the portfolio try short, like a zero-commission alternative including Tangerine.

In the end, understand that words evolves through the years and meanings can alter. When you’re “inactive” ‘s been around for a few decades now, its utilize will get shift because the social thinking to your spare time and productivity consistently develop. Inside preferred community, the picture of a passive might have been illustrated in almost any implies. Such as, in the eighties Program Hitched… with College students, Al Bundy is often represented lounging to the his sofa if you are sipping alcohol and you can viewing sporting events. Now, suggests such as the Big-bang Theory have looked emails who purchase times to try out games instead of getting into genuine-life things. The brand new idiom “inactive” is a proper-recognized term accustomed determine somebody who uses most of their time sitting on the couch, watching television or performing absolutely nothing.